Instead of providing health insurance to their employees they increase the compensation of their employees to allow them to acquire health insurance. Ad Compare 50 Medical Insurance Plans Designed for Expatriates.

Bajaj Allianz General Insurance Is Eyeing For 30 Of Its Total Two Wheeler Insurance Sales Through Long Term General Insurance Online Insurance Insurance Sales

Ad Search for results at TravelSearchExpert.

2 health insurance s corp. If you provide health insurance to employees who own more than 2 of stock in your S Corp the premiums are tax deductible for your company. This is not a business deduction. Reporting to the shareholder.

Many S corporations have shifted to a direct pay model for health insurance. Find info on Websearch101. Get a Free Quote.

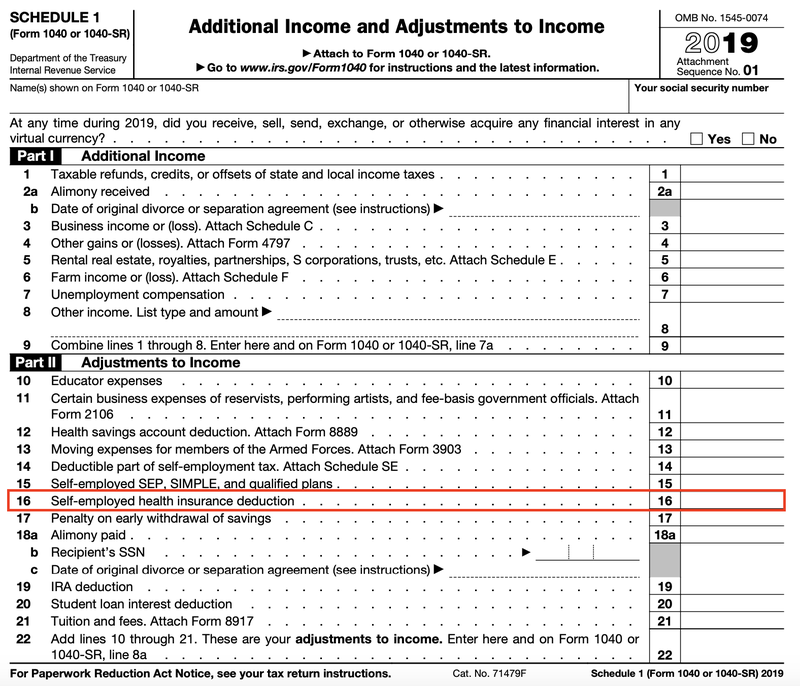

So what is the 2. Shareholder health insurance for a more than 2 owner is to be reported on their W-2 and if possible the shareholder would make an adjustment on the front of their 1040 return. - Applicable For Foreign Citizens Only - Not for Local citizens students.

Pay insurance costs through your S corporation. In order to preserve a tax deduction for the greater than 2 S corporation shareholder it is important to comply with these rules. - Applicable For Foreign Citizens Only - Not for Local citizens students.

This title also applies to those who possess more than 2 of the total combined voting power of all stock of the corporation. - Free Quote - Fast Secure - 5 Star Service - Top Providers. When youre an S corporation owner with more than 2 of the company stock youre treated the same as a self-employed person when it comes to deducting health insurance premiums.

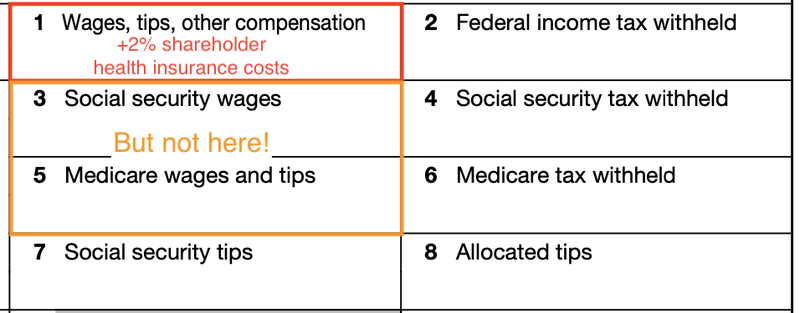

The cost of health insurance premiums paid by the S corporation for a 2 shareholder is included in the shareholders W-2 as Box 1 taxable income. Ad Search for results at Websearch101. The amount is subject to federal income tax withholding.

Health insurance premiums paid by an S corporation on behalf of its 2 percent shareholders should be reported as wages on shareholder W-2 forms. You must include the amount of the S Corp shareholder health insurance premium in the employees taxable wages. Find info on TravelSearchExpert.

This would create a second class of stock thus nullifying the S-Corporation election. And the premium amounts are taxable for your employees. It is not subject to FICA and FUTA taxes if the payments are made under a plan for employees generally.

Health Insurance for S Corporation 2 Shareholders. Health insurance premiums paid by an S corporation on behalf of its 2 shareholders should be deducted by the S corporation. Ad Compare 50 Medical Insurance Plans Designed for Expatriates.

Your S corp must pay your health insurance costs to get the personal tax deduction. Less than 2 shareholder health insurance is included with the expense for other. Find info on MySearchExperts.

Get the Best Quote and Save 30 Today. S-Corp to include the health insurance premiums on Form 1120S Line 7 Officer compensation. Too often these payments are not included in wages because the premiums are paid along with those for rank-and-file employees.

S-Corp to include the health insurance premiums in the 2 shareholder-employees W-2 Box 1 wages but not Box 3 SS wages and Box 5 Medicare wages. S Corporation payments or reimbursements of health and accident insurance premiums paid on behalf of a greater than 2 S corporation shareholder are subject to special rules which require careful attention. Over 1 Million Hospitals Clinics And Physicians Worldwide.

It is a special personal deduction you take on the first page of your Form 1040 as self-employed health insurance. Get a Free Quote. Ad Looking After Your Health And Well-Being In These Unsettling Times Is Our Priority.

If an S corp only has one employee or if a second employee is a spouse or dependent these requirements do not apply. According to the Internal Revenue Service IRS a 2 S corporation shareholder is someone who owns more than 2 of the companys stock at any time during the year. 2 shareholder health insurance.

S-Corp to pay or reimburse the health insurance premiums. From the corporations perspective premiums are different than payroll. Ad Compare Top Expat Health Insurance In Indonesia.

Ad Health Insurance Plans Designed for Expats Living Working in Indonesia. Get An Expat Quote Today. Ad Search for Health insurance at MySearchExperts.

A Beginner S Guide To S Corp Health Insurance The Blueprint

Taxable Items And Nontaxable Items Chart Income Accounting And Finance Finance

What Do I Need To Know About Deducting Self Employed Health Insurancea Find Out More On These Topics Pl I Need To Know Health Savings Account Health Planning

A Beginner S Guide To S Corp Health Insurance The Blueprint

Best Small Business Health Insurance Options For 2021 Best Health Insurance Health Insurance Options Business Insurance

A Beginner S Guide To S Corp Health Insurance The Blueprint

W2 Independence A New More Inclusive Umbrella For The Fire Community W2 Forms Power Of Attorney Form Tax Forms

Shopping For Health Insurance Visual Ly Buy Health Insurance Marketplace Health Insurance Affordable Health Insurance

Zocdoc Gives The Health Insurance Card A Brilliant Makeover Health Insurance Medical Insurance Health Insurance Coverage

S Corp Profitable Business S Corporation Tax Services

Hottest Totally Free How To Choose Best Health Insurance Company In India September 2019 Tho Health Insurance Companies Health Insurance Best Health Insurance

Important Changes For 2019 And 2020 Filing Forms 1099 Misc Irs Forms Irs Efile

Benifits Of 24 Hours Medical Billing Services Medical Billing Service Medical Billing Health Care Insurance

Can An S Corporation Issue Qualified Small Business Stock S Corporation Law Blog Start Up

2 Year Nursing Programs Nursingadministrator Gerontology Gerontology Careers Online Nursing Schools

0 komentar

Posting Komentar