Dilip Sarwate Nov 16 18 at 344. You can then transfer the total of.

A self-employed person does not deduct hisher health insurance premiums of Schedule C Line 29 at all.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at11.48.59AM-e4b3de27a8544337b02af39530d548d6.png)

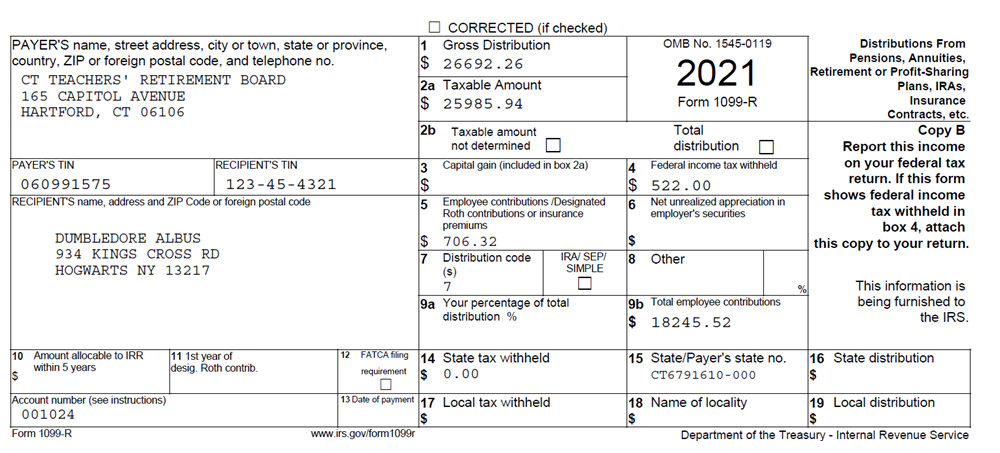

1099-r health insurance premium deduction. Health care costs for the self-employed person are deducted on Form 1040 Line 29. However you also must be itemizing deductions to see the benefit on your return. Specific Instructions for Form 1099-R.

The software then treats the entire amount here as an itemized medical deduction which would be on Schedule A. Get A Quote Now. Access To More Than 110 Board Certified Doctors With Ranging Specialisms.

This must be entered manually on Schedule A. Write-offs are available whether or not you itemize if you meet the requirements. Ad Health Insurance Plans Designed for Expats Living Working in Indonesia.

If the individual qualifies for the insurance premium exclusion it should be indicated on line 16b of Form 1040. Wage Deduction is for entering the portion of the health insurance costs that is withheld from a paycheck on an after-tax basis or amounts paid directly to the insurer by a salaried employee. Ad Health Insurance Plans Designed for Expats Living Working in Indonesia.

File Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from profit-sharing or retirement plans any individual retirement arrangements IRAs annuities. Access To More Than 110 Board Certified Doctors With Ranging Specialisms. See the DissoMaster.

Ad Video And Telephone Consultations With Doctors Nurses Healthcare Specialists. Self-employed persons can take a deduction for health insurance premiums they pay for themselves and their dependents directly on line 16 of the 2020 Schedule 1. - Applicable For Foreign Citizens Only - Not for Local citizens students.

If reported on your 1099-R your insurance premiums will be reported in box 5. Get A Quote Now. Here we have everything you need.

Specific Instructions for Form 1099-R File Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc for each person to whom you have made a designated distribution or are treated as having made a. In the 1099-R worksheet in ProSeries there are separate boxes to check for 1099-R CSA 1099-R and a couple others including Railroad Retirement. To take this exclusion reduce the otherwise taxable amount of your pension or annuity by the amount excluded.

Ad Compare 50 Medical Insurance Plans Designed for Expatriates. Get a Free Quote. This is another above-the-line adjustment to income.

Ad Compare 50 Medical Insurance Plans Designed for Expatriates. - Applicable For Foreign Citizens Only - Not for Local citizens students. Here we have everything you need.

To deduct medical expenses you must have expenses at least 10 of your AGI unless you are over 65 which is still 7 12. That line is for health insurance costs paid for the other employees if any of the self-employed person. Ad Video And Telephone Consultations With Doctors Nurses Healthcare Specialists.

If your medical premiums are deducted through a payroll deduction plan its more than likely that youre covering your share of your insurance premium with pre-tax dollars. So if you deducted. Remember that the amount shown in box 2a of Form 1099-R does not reflect the health care premium exclusion.

After you check the CSA 1099-R box you are given a different worksheet that includes a field for deductible health insurance premiums. Most self-employed taxpayers can deduct health insurance premiums including age-based premiums for long-term care coverage. Get a Free Quote.

Taxes 1099 R Public Employee Retirement System Of Idaho

Https Apps Irs Gov App Vita Content Globalmedia 1099r Pension And Annuity Income 4012 Pdf

Https Apps Irs Gov App Vita Content Globalmedia 1099r Pension And Annuity Income 4012 Pdf

How To Read Your 1099 R Colorado Pera

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

W2 Independence A New More Inclusive Umbrella For The Fire Community Power Of Attorney Form W2 Forms Rental Agreement Templates

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Efile

Https Www Pers Ms Gov Content 1099 Understanding Your Irs Form 1099r Pdf

Self Employed Medicare Retiree Box 5 On 1099 R Is Empty Is Health Insurance Deductible 1040 Line 29 Personal Finance Money Stack Exchange

1099s In The Age Of Coronavirus Wh Cornerstone Investments Financial Planning For Widows

Section 80c 80cc Deductions Income Tax Deductions Under Chapter Vi For Ay 2022 23 Tax Deductions Income Tax Income Tax Return

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Irs Form 1099 R Box 7 Distribution Codes Ascensus

Https Apps Irs Gov App Vita Content Globalmedia 1099r Pension And Annuity Income 4012 Pdf

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at11.48.59AM-e4b3de27a8544337b02af39530d548d6.png)

Form 1099 H Health Coverage Tax Credit Advance Payments Definition

To Your Sage 100 Erp 2014 W2 Form Printing We Ve Got The Answer Es0sqqn8 Tax Forms W2 Forms Tax Time

0 komentar

Posting Komentar