C corporation health insurance deductions can be taken for health plan premiums paid for shareholders employees and their families no matter how large or small the corporation may be. These plans include various coverage features like hospitalisation critical illness cover maternity coverage etc.

Care Health Insurance Wikipedia

Find info on Websearch101.

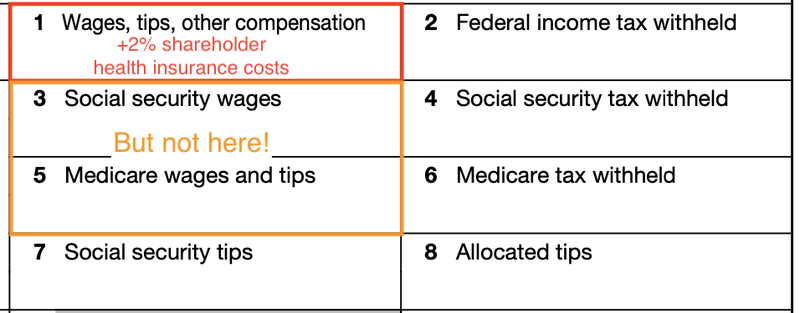

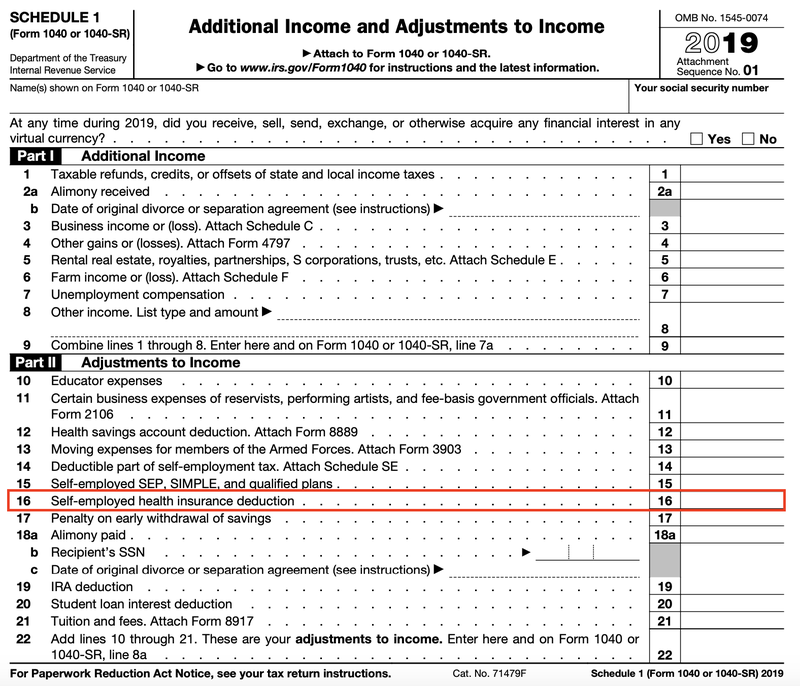

C corp health insurance. Ad Health Insurance Plans Designed for Expats Living Working in Indonesia. In contrast S corporation shareholders must report the benefit as income and then deduct the premiums from gross income on their personal returns. There are no specific rules prohibiting or limiting the ability for a C Corp to pay and deduct as a business expense the cost of medical insurance.

Some states dont allow corporations to buy health insurance policies when theres only one employee. Generally this insurance plan is uniform in nature and offers the same benefits to. It is one of the benefits of establishing a business as a C corporation rather than the other choices available to business owners which include sole proprietorships LLCs and even S corporations.

How is it handled in a C-Corp. A corporate entity can become somewhat of a target in our quick-to-file-a-lawsuit society making this coverage critical to protect the financial well-being of your corporation. Ad Compare Top Expat Health Insurance In Indonesia.

For C-corp health insurance premiums paid for employees and families that qualify as nondiscriminatory are deductible for C-corp and excludable from gross income for shareholders. - Applicable For Foreign Citizens Only - Not for Local citizens students. One of the most important corporate insurance Group Health Insurance offers healthcare benefits to a group of people ie.

There are however tax implications to highly compensated employees and since you are the only employee those rules will apply to you. Ad Compare 50 Medical Insurance Plans Designed for Expatriates. The corporation can fully deduct its premiums.

Get a Free Quote. In any case you can qualify for a self-employed health insurance tax deduction. I have a client who is the sole employee of his C corporation.

The employees of an organization. Owners of a C corporation can receive health coverage on a tax-free basis. Ad Search for results at Websearch101.

Ad Compare 50 Medical Insurance Plans Designed for Expatriates. Client is adament that he should get the deduction and in past paid his corp RE developement fees to offset his medical expenses and zero his corp income. Get the Best Quote and Save 30 Today.

Find info on TravelSearchExpert. Updated November 9 2020. Can he continue having his C corporation reimburse him for his health insurance payments.

- Applicable For Foreign Citizens Only - Not for Local citizens students. Corporate health insurance plans are essentially group insurance policies wherein a common set of health insurance benefits are available to a group of people more specifically the employees. Knowing about c corporation shareholder health insurance is an important part of running a successful corporation.

Ad Search for results at TravelSearchExpert. It also doesnt matter if premiums are paid directly from the business account or reimbursed to the employeeThe premiums are not included in the stockholders w-2 as payroll and or fringe benefits. Get a Free Quote.

According to this article if I am interpreting it correctly it states that if you have only one employee then you are exempt from the Affordable Care Act ACA rules. Since a corporation is not considered a pass-through entity the owners are completely separate from the company in terms of taxes. Group Health Insurance.

Corporate liability insurance in any form is arguably the most important insurance for a business. Get A Quote Now. - Free Quote - Fast Secure - 5 Star Service - Top Providers.

Ad Video And Telephone Consultations With Doctors Nurses Healthcare Specialists. Access To More Than 110 Board Certified Doctors With Ranging Specialisms. You can have a medical reimbursement plan through the company.

Pin On Legal Tips For The Self Represented

A Beginner S Guide To S Corp Health Insurance The Blueprint

Pin On Insightful Insurance Blogs

Advantages And Responsibilities Of An S Corp Small Business Tax Business Tax Health Insurance Humor

A Beginner S Guide To S Corp Health Insurance The Blueprint

A List Of Best Life Insurance Leads Companies Life Insurance For Seniors Life Insurance Companies Best Life Insurance Companies

Universal Health Coverage In Indonesia Concept Progress And Challenges The Lancet

E File Your 1099 Misc Form Online In 5 Easy Steps Online Efile Irs Extension

Why You Should Have Wedding Insurance New York Wedding Florist New York Event Design New York Event Decor Wedding Insurance New York Wedding Wedding Planning Tips

Health Insurance Companies Health Care Services Health Insurance

Do You Need Small Business Insurance With An Llc Or Corporation Small Business Insurance Business Insurance Health Insurance Humor

A Beginner S Guide To S Corp Health Insurance The Blueprint

Council Of Cooperative Health Insurance Council Of Cooperative Health Insurance

Timeline Photos R David Bulen Insurance Life Insurance Quotes Health Insurance Cost Best Health Insurance

What Is Difference Between Corporation Llc Limited Partnership And Sole Proprietorship In C Sole Proprietorship Limited Partnership Limited Liability Company

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Pin By Zeflar Corp On Insurance Life Insurance Sales Life Insurance Marketing Ideas Life Insurance Marketing

Shopping For Health Insurance Visual Ly Buy Health Insurance Marketplace Health Insurance Affordable Health Insurance

0 komentar

Posting Komentar